Donation to the J. Kirk Endowment

A donation to the J. Kirk Endowment is a donation which will be invested and never spent or distributed.

Your donation to the Endowment will insure longevity and stability of J. Kirk Foundation. The Endowment will never be spent. Annually, the interest from Endowment will be drawn out and divided into the four program disbursement funds of the organization.

Ten percent (10%) of the interest of the Endowment will be dedicated to the operating costs of the organization, the remaining ninety percent will be distributed to the disbursement accounts in the following percentages: forty-five percent (45%) of the total annual interest of the Endowment will be disbursed to the Spay/Neuter Reimbursement Fund, twenty-two and one half percent (22.5%) of the total annual interest of the Endowment will be dispersed to the Animal Emergency Reimbursement Fund and, twenty-two and one half percent (22.5%) of the total annual interest of the Endowment will be disbursed to the Veterinary Student Tuition Reimbursement Fund.

donation to the Spay/Neuter Fund

A donation to the Spay/Neuter Fund will augment the annual interest contribution made to this fund by the J. Kirk Endowment.

Your donation to the Spay/Neuter Fund will further allow J. Kirk Foundation to reimburse pet owners for spay and neuter surgeries for their pets.

J. Kirk Foundation will grant up to two surgery reimbursements per year, per low income pet owner for low cost spay and neuter surgeries.

Donation to the Emergency Animal Care Fund

A donation to the Emergency Animal Care Fund will augment the annual interest contribution made to this fund by the J. Kirk Endowment.

Your donation to the Emergency Animal Care Fund will further allow J. Kirk Foundation to reimburse low income pet owners for emergency needs for their pets.

J. Kirk Foundation will grant reimbursements in the amount of $100 for emergency food or supplies or up to $200 for emergency medical needs per year, per pet owner.

Donation to The Veterinary Tuition Fund

A donation to the Veterinary Tuition Reimbursement Fund will augment the annual interest contribution made to this fund by the J. Kirk Endowment.

Your donation to the Veterinary Tuition Reimbursement Fund will further allow the organization to partially reimburse the tuition of a Washington State University Student of Veterinary medicine who has graduated and has successfully obtained heir Idaho State Veterinary License and has spent at least one year practicing as a veterinarian in a spay neuter clinic, Animal Welfare Organization or has performed one thousand spay and neuter surgeries in the first three years of their practice.

Donation to the Operational Fund

A donation to the Operational Fund will augment the annual interest contribution made to this fund by the J. Kirk Endowment.

Your donation to the Operational Fund will further allow J. Kirk Foundation to operate on a day to day basis.

Since J. Kirk Foundation does not have payroll, donations made to this fund will cover costs of bookkeeping, postage, website costs, bank charges and office supplies.

Donate as a Gift to friends or family Member

We encourage you to make a donation as a gift to someone you care about!

Weather your generosity is a gift for a holiday, a birthday, an anniversary, or just because, this is the perfect gift for that someone who is impossible to shop for or has everything they will ever need.

After you click the donate now button, please click on the optional note link and let us know what specific fund you are designating your donation to, tell the reason of your gift and let us know who to send an acknowledgement to. A letter will be sent to them by J. Kirk Foundation acknowledging your generosity.

Vehicle Donation Program

Donate Your Car, Boat or Other Vehicle

It is easy to make a contribution to J. Kirk Foundation and Animal Assistance League while earning yourself a valuable tax deduction!

If you have an unwanted car, boat or plane just gathering dust, but don't want the hassle of having to sell it, consider donating it to J. Kirk Foundation and Animal Assistance League . Funds from donated vehicles will support the programs and services we provide to our community. It is as easy as one toll-free phone call to 877-721-PETS (877-721-7387) OR you can complete the donation form on this page.

A representative will schedule a pick up time for your vehicle that's convenient for you and provide you with confirmation of your donation, all at no cost to you! Once your vehicle is sold, you will be sent a receipt for your tax records and the sale proceeds will be donated to J. Kirk Foundation and Animal Assistance League in your name.

To learn more about this exciting program, call 877-721-PETS (877-721-7387).

OTHER WAYS TO GIVE

Here are Ten Easy Ways to Minimize Your Taxes and Maximize Your Gifts to J. Kirk Foundation and Animal Assistance League

Gifts of Cash

Cash contributions to J. Kirk Foundation and Animal Assistance League are deductible as an itemized deduction in the year you make the donation, up to a total of 50 percent of your adjusted gross income. Excess charitable deduction can be carried forward for up to five additional years.

Gifts of Securities

If you donate stocks or mutual funds to J. Kirk Foundation and Animal Assistance League that have risen in value and you’ve held for more than one year, you pay no capital gains tax on the transaction and are entitled to a charitable contribution for the full fair market value of the stock. If you wish to keep a certain stock in your portfolio, you could donate the stock and then use cash to buy the same stock, thus increasing your cost basis to current fair market value. If you have stock losses, generally you should not contribute the stock, but rather sell the stock yourself to realize the loss for tax purposes. You can then contribute the cash and take a charitable deduction.

Gifts of Real Estate

If you own property that is not subject to a mortgage and has appreciated in value, a charitable gift of real estate to J. Kirk Foundation and Animal Assistance League may be an attractive option. You can claim an income tax deduction based upon the fair market value of the property, avoid all capital gains taxes and remove that asset from your taxable estate.

Retirement Plan Assets

Your most efficient estate planning option may be leaving all or a portion of your retirement plan to J. Kirk Foundation and Animal Assistance League. Tax laws often subject these assets to the highest combined income and estate tax upon death. Many techniques can be used to avoid combined tax rates of nearly 65 percent. At the same time, you can pass more tax-favored assets to your family. You can also make tax-free gifts from your IRA. You can direct your mandatory withdrawal amount (or any amount up to $100,000 a year) to be used to make charitable gifts on a totally tax–free basis. A donation of your IRA could also result in maximizing your social security benefits.

Charitable Gift Annuity

Through a simple agreement between you and J. Kirk Foundation and Animal Assistance League, we acquire an annuity contract on your behalf with funds or property you donate to us. That contract provides you as the annuitant with a fixed dollar distribution each month or quarter for the rest of your life. Generally, the older you are at the time of the gift, the higher the annuity payout. You can also fund the gift with appreciated property that, in addition to a charitable deduction for the gift, may spread those capital gains out over your lifetime.

Life Income Gifts

Life income gifts allow you to receive an income as a result of making a charitable gift. Depending on the plan you choose, the income can be fixed or variable and can be for you or other beneficiaries you choose. For example, you might create a Charitable Remainder Trust to pay income to you for life or a period of time not to exceed 20 years and contribute money, stock, or other property to it. Once placed in the trust, the assets can be sold (without capital gains tax) and the proceeds reinvested to produce a higher yield. Life income gifts entitle you to an immediate income tax deduction, which is based upon the present value of your gift to us. At the end of the trust’s term, the balance in the trust supports our mission.

Bequests

By putting J. Kirk Foundation and Animal Assistance League in your will or trust and leaving a percentage of your estate, or making a specific bequest of money or a particular piece of property to our organization, you would be creating a lifetime legacy for animals in our community.

Retained Life Estates

Retained life estates allow you to transfer the deed of your personal residence to J. Kirk Foundation and Animal Assistance League now and keep the right to live in and use the property for your lifetime. You will receive a current charitable deduction in the amount that is based on your life expectancy and the value of the property.

Life Insurance

You can contribute a life insurance policy to our organization by naming J. Kirk Foundation and Animal Assistance League either as the owner and beneficiary or simply the beneficiary. If you name our organization as both, you will be entitled to an income tax deduction limited to the lower of the value of the policy or your cost basis in the contract.

Bank Accounts & CD’s

You can name J. Kirk Foundation and Animal Assistance League as the “payable-on-death beneficiary” of your bank accounts or certificates of deposit. You own the assets for your lifetime and have them available for your use. Upon your death, the assets pass directly to our organization without going through probate.

Before donating to J. Kirk Foundation and Animal Assistance League or any charity, it is always recommended you talk with your tax advisor.

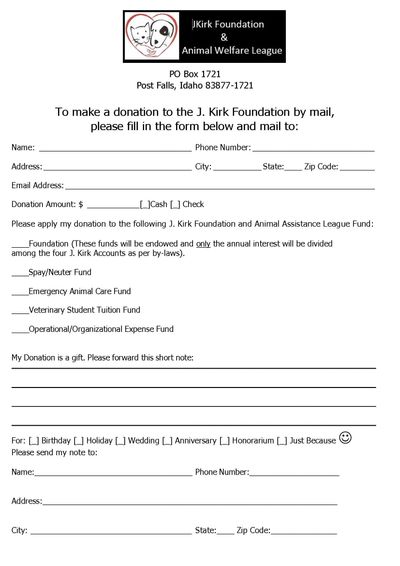

donation by mail

All donations made to J. Kirk Foundation and Animal Assistance League are 100% tax deductible.

If you choose to donate by mail, please download and print the donation form to the left. Once completed, please mail your gift to J.Kirk Foundation, PO Box 1721, Post Falls, Idaho 83872-1721

Download and print donation Form

Copyright © 2019 JKirk Foundation and Animal Welfare League - All Rights Reserved.